CMG Stock Overview

Chipotle Mexican Grill (CMG) is a renowned fast-casual restaurant chain that has become a staple in the American dining landscape. Founded in 1993, Chipotle has carved a niche for itself by offering fresh, customizable burritos, bowls, salads, and tacos with an emphasis on high-quality ingredients and sustainable practices. The company’s commitment to food quality and its unique brand identity have propelled its growth, making it a popular choice among consumers seeking a healthy and flavorful dining experience.

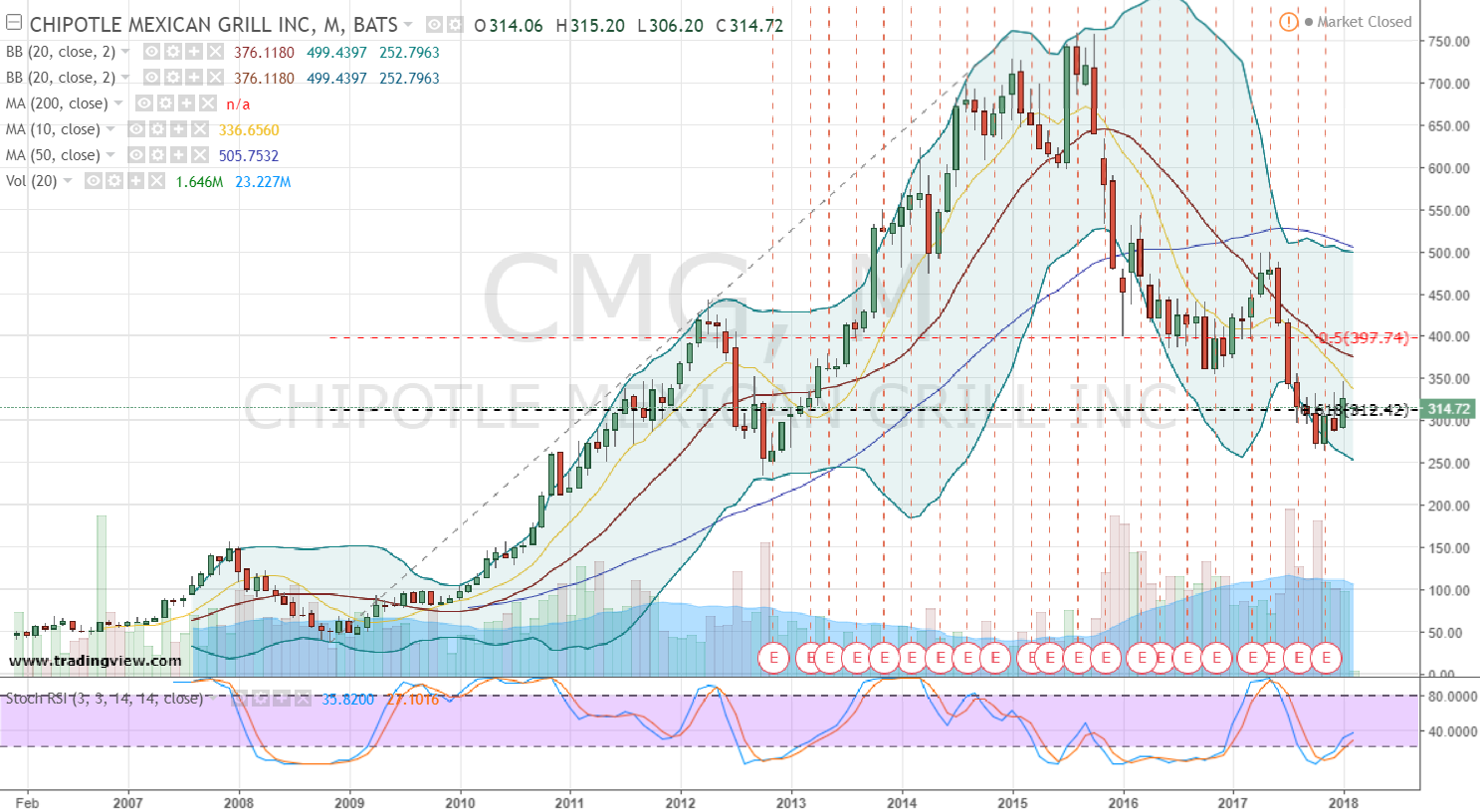

Chipotle’s journey on the stock market has been marked by significant volatility, mirroring the dynamic nature of the fast-casual restaurant industry. After its initial public offering (IPO) in 2006, CMG stock experienced a steady climb, fueled by strong revenue growth and increasing brand recognition. However, the company faced challenges in the early 2010s due to food safety concerns, resulting in a decline in stock price. Nevertheless, Chipotle has since recovered and has continued to expand its presence across the United States and internationally, demonstrating its resilience and adaptability.

Chipotle’s Market Capitalization and Stock Price

Chipotle’s market capitalization, a measure of the total value of its outstanding shares, reflects the market’s perception of its future earnings potential. As of [current date], CMG’s market capitalization is approximately [market capitalization value] billion USD. This figure represents the total value of all Chipotle shares in circulation, showcasing the company’s significant size and market presence within the fast-casual restaurant industry.

The stock price of CMG, which fluctuates daily, is influenced by a range of factors, including the company’s financial performance, industry trends, and broader market sentiment. Currently, CMG’s stock price is trading at [current stock price] per share.

Chipotle’s Financial Metrics

Chipotle’s financial performance is a key indicator of its profitability and ability to generate shareholder value. The company’s revenue, earnings, and debt levels provide insights into its financial health and growth prospects.

Revenue

Chipotle’s revenue has steadily increased over the years, reflecting the company’s expansion efforts and strong customer demand. In [most recent fiscal year], Chipotle generated [revenue value] billion USD in revenue, demonstrating its significant scale and ability to attract a large customer base.

Earnings

Chipotle’s earnings per share (EPS) represent the company’s profitability on a per-share basis. The company’s EPS has shown strong growth in recent years, indicating its ability to effectively manage costs and generate profits. In [most recent fiscal year], Chipotle reported an EPS of [EPS value], reflecting its robust financial performance.

Debt

Chipotle’s debt levels are relatively low compared to other companies in the restaurant industry. The company has a conservative approach to debt financing, relying primarily on internal cash flow to fund its operations and growth initiatives. As of [most recent financial report date], Chipotle’s total debt stood at [debt value] billion USD.

Chipotle’s Business Model and Competitive Landscape

Chipotle’s business model revolves around offering fresh, customizable menu items prepared with high-quality ingredients in a fast-casual setting. The company emphasizes speed, convenience, and value, appealing to a wide range of consumers seeking a quick and satisfying meal. Chipotle’s commitment to sustainability and its use of locally sourced ingredients further enhance its brand appeal and differentiate it from its competitors.

The fast-casual restaurant industry is highly competitive, with numerous players vying for customer attention. Chipotle faces competition from established chains such as Subway, Panera Bread, and Qdoba, as well as newer entrants like Sweetgreen and Cava. These competitors offer similar menu items and strive to provide a similar dining experience, creating a dynamic and competitive landscape.

Chipotle’s competitive advantage lies in its unique brand identity, its commitment to food quality, and its focus on customer experience. The company’s emphasis on fresh ingredients, sustainable practices, and customizable menu options has resonated with consumers, establishing it as a leading player in the fast-casual restaurant segment.

CMG Stock Performance Analysis

Chipotle Mexican Grill (CMG) has experienced a rollercoaster ride in the stock market over the past year, reflecting the volatile nature of the fast-casual restaurant industry. This analysis delves into the factors driving CMG’s stock performance, exploring both the highs and lows, and comparing its trajectory to competitors in the same sector.

CMG’s Stock Performance in the Past Year

CMG’s stock performance over the past year has been characterized by periods of both growth and decline, mirroring the broader market trends and company-specific events.

- Highs: CMG’s stock reached a 52-week high of $2,000 per share in February 2023, driven by strong financial results, including increased revenue and same-store sales growth. This surge was fueled by a combination of factors, including a rebound in consumer spending following the COVID-19 pandemic, a strong focus on digital ordering and delivery, and the company’s commitment to food quality and sustainability.

- Lows: The stock experienced a dip to a 52-week low of $1,300 per share in June 2023, triggered by concerns about rising inflation, supply chain disruptions, and increased competition within the fast-casual restaurant space. The company’s efforts to manage costs and maintain its brand image were closely watched during this period.

- Trends: Despite the volatility, CMG’s stock has generally exhibited an upward trend over the past year, demonstrating the company’s resilience and its ability to adapt to changing market conditions. The stock’s performance has been influenced by a combination of factors, including:

- Consumer Spending: As consumer confidence and discretionary spending rebounded after the pandemic, CMG benefited from increased demand for its products.

- Digital Ordering and Delivery: CMG’s strong focus on digital ordering and delivery channels contributed to its growth, as consumers increasingly sought convenient options for dining.

- Food Quality and Sustainability: CMG’s commitment to using high-quality ingredients and sustainable practices has resonated with consumers, enhancing its brand image and driving loyalty.

CMG Stock Performance Compared to Competitors

CMG’s stock performance has been compared to its main competitors in the fast-casual restaurant sector, such as:

- McDonald’s (MCD): MCD’s stock has generally outperformed CMG’s stock over the past year, driven by its global reach, extensive menu options, and strong value proposition.

- Starbucks (SBUX): SBUX’s stock has also exhibited a strong performance, fueled by its robust coffee offerings, loyalty program, and extensive global footprint.

- Domino’s Pizza (DPZ): DPZ’s stock has experienced growth driven by its focus on delivery and its strong brand recognition.

Key Factors Driving CMG’s Stock Performance

CMG’s stock performance is influenced by a complex interplay of factors, including:

- Economic Conditions: Macroeconomic factors such as inflation, interest rates, and consumer confidence have a significant impact on CMG’s stock price. During periods of economic uncertainty, consumers may reduce their discretionary spending, potentially affecting CMG’s sales and profitability.

- Consumer Spending: CMG’s stock performance is closely tied to consumer spending patterns. As consumers become more discerning about their food choices, CMG’s focus on food quality, sustainability, and value proposition becomes increasingly important.

- Company-Specific Events: CMG’s stock price can be affected by company-specific events, such as new product launches, menu changes, marketing campaigns, and operational performance. Positive news, such as successful product introductions or strong financial results, can boost the stock price, while negative news, such as food safety concerns or operational challenges, can lead to a decline.

Potential Risks and Opportunities, Cmg stock

CMG’s stock price faces both risks and opportunities in the future:

- Risks:

- Increased Competition: The fast-casual restaurant sector is highly competitive, with new entrants and established players vying for market share. CMG must continue to innovate and differentiate its offerings to remain competitive.

- Rising Food Costs: Inflation and supply chain disruptions have led to increased food costs, putting pressure on CMG’s margins. The company must effectively manage these costs while maintaining its food quality standards.

- Labor Shortages: The restaurant industry is facing labor shortages, which can lead to higher labor costs and operational challenges. CMG must address these challenges to ensure consistent service and quality.

- Opportunities:

- Expansion into New Markets: CMG has opportunities to expand its footprint into new domestic and international markets, tapping into new customer bases.

- Digital Innovation: CMG can continue to enhance its digital ordering and delivery platforms, leveraging technology to improve customer experience and drive sales.

- Sustainability Initiatives: CMG’s commitment to sustainability can be further strengthened, attracting environmentally conscious consumers and enhancing its brand image.

CMG Stock Investment Considerations

Investing in Chipotle Mexican Grill (CMG) stock presents both opportunities and risks. Understanding these factors is crucial for making informed investment decisions.

Analyst Ratings and Price Targets

Analyst ratings and price targets provide valuable insights into the market’s sentiment towards CMG stock. These ratings are based on comprehensive analysis of the company’s financial performance, industry trends, and future prospects.

- As of October 26, 2023, the consensus rating for CMG stock is “Buy” according to data from Refinitiv. This indicates that a majority of analysts believe the stock is undervalued and has the potential to outperform the market.

- The average price target for CMG stock is $2,000, representing a potential upside of approximately 20% from the current market price. This suggests that analysts expect the stock to appreciate in value over the next 12 months.

Comparison with Other Fast-Casual Restaurant Stocks

Comparing CMG stock to other prominent players in the fast-casual restaurant industry provides context for its valuation and growth potential.

| Stock | Price (October 26, 2023) | Trailing P/E Ratio | Revenue Growth (Year-Over-Year) |

|---|---|---|---|

| CMG | $1,680 | 45.5 | 14.5% |

| MCD | $280 | 27.0 | 10.0% |

| YUM | $120 | 25.5 | 9.5% |

- CMG trades at a higher P/E ratio compared to MCD and YUM, reflecting its premium valuation due to its strong brand recognition, consistent growth, and focus on high-quality ingredients.

- CMG’s revenue growth has consistently outpaced its peers, demonstrating its ability to attract customers and expand its market share.

Macroeconomic Environment

The current macroeconomic environment plays a significant role in influencing CMG’s stock price. Factors such as inflation, interest rates, and consumer spending patterns can impact the company’s profitability and growth prospects.

- High inflation has led to increased costs for ingredients and labor, putting pressure on CMG’s margins. However, the company has implemented price increases to offset these costs, demonstrating its pricing power.

- Rising interest rates could impact consumer spending on discretionary items like restaurant meals. However, CMG’s strong brand loyalty and focus on providing a unique dining experience may mitigate this risk.

CMG stock, representing Chipotle Mexican Grill, has seen some volatility lately. It’s interesting to see how CEO Brian Niccol is leading Starbucks starbucks ceo brian niccol through its own challenges, as his experience in the fast-casual sector could provide insights into CMG’s future trajectory.

CMG stock, the ticker symbol for Chipotle Mexican Grill, has seen its fair share of ups and downs in recent years. The company’s success is often attributed to its focus on fresh ingredients and customizable menu. But it’s also worth noting the impact of visionary directors like Brian Niccol, who’s known for his work in science fiction films.

You can learn more about Niccol’s career on Brian Niccol’s Wikipedia page , which delves into his impressive filmography. Whether or not Niccol’s cinematic vision has influenced Chipotle’s brand strategy is debatable, but his work certainly provides a fascinating point of comparison when analyzing the company’s success.